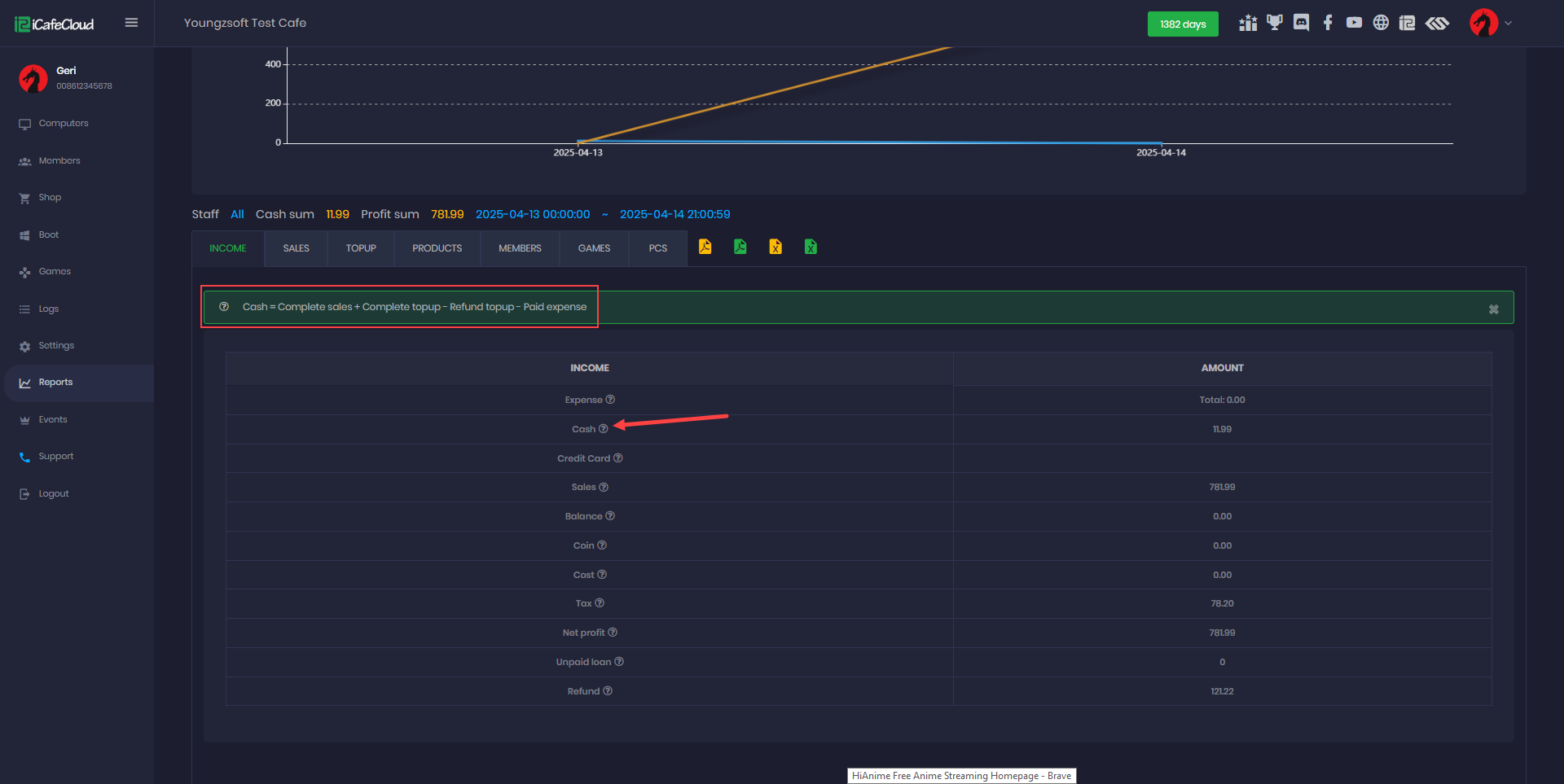

Wiki Home Reports page Income report

Income report

2025-03-14

income, reports

The following explains the detailed formulas used for report calculations can be found on the Income, Sales, Top-Up, and Product pages.

- Expenses = Paid expense.

- Cash = Completed sales + Complete topup + Tax - Refunds - Paid Expenses

Ex: Sales is 100$ + Topup 100$ + TAX 10% - Refund 100$ -Paid expense 20$ = (100 + 110 include tax - 100 - 20) = 90$ Cash - Credit card = Completed sales + Complete Topup + Tax - Refunds.

- Sales = Cash amount + credit card amount

- Balance = Completed Sales

- Coin = complete sales

- Cost = Sales Cost

- Tax = Sales Tax + Topup Tax

- Net profit = Totals sales - Tax - Cost

A more detailed calculation for net profit involves subtracting the total cost and taxes from the total sales. For instance, if the total sales amount to $100, the cost is $30, and taxes amount to $20, the net profit can be determined as follows: $100 (total sales) - $30 (cost) - $20 (taxes) = $50. Therefore, the net profit in this example is $50.

Pay by Balance in NetProfit counts only the cost.

Ex: Price 10$ cost 5$ = Netprofit -5$ (This happens because balance is already calculated as topup)

Pay by Coins in Net profit does not count at all as coins are separate monetary. - Unpaid Loan

- Refund = Sales Refund + Topup Refund

- Click the question mark button on any report page to view the formula used for that specific calculation.(Figure 1)

Figure 1